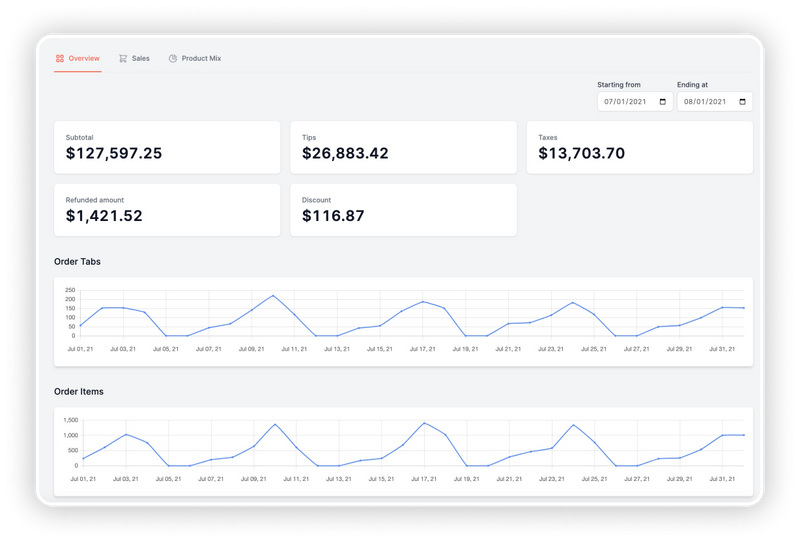

When SNAPnTAP entered the collaborative space, we knew how imperative it was to make financial management for collaborating merchants as simple and easy as possible. And that’s exactly what we did. SNAPnTAP automatically splits transactions by merchant so each merchant receives their portion of funds directly and instantly.

When merchants collaborated during the pandemic, problems with finances arose. One SNAPnTAP brewery partner told us how their staff had to sell food supplied by visiting food trucks in order to sell beer. As a result, staff were forced to ring up food sales on their point-of-sale system, which meant the brewery’s financial accounts were inclusive of food sales which belonged to different businesses.

Three critical issues arose from this workflow. First, an accountant had to spend time separating sales that belonged to the brewery from those that belonged to food trucks. Second, once that separation was complete, only then could payouts be made. This took time and meant food trucks had to wait a while to receive their money. Third, because the brewery’s financial books were inclusive of sales on behalf of other businesses, their numbers were inflated. This negatively impacted everything from submitting tax reports to applying for PPP loans.

When SNAPnTAP entered the collaborative space, we knew how imperative it was to make financial management for collaborating merchants as simple and easy as possible. And that’s exactly what we did.

With SNAPnTAP, accounting is completely automated. When a customer orders from multiple merchants through SNAPnTAP’s payment channels, SNAPnTAP will separate items on the order by merchant, and then send each merchant the total sum of money for their ordered items.

Example

Let’s build off of the example used in our last post. A customer visits a brewery with a visiting taco truck and orders from both at the bar (a 16oz IPA from the brewery and a taco platter from the taco truck).

Before SNAPnTAP, the brewery would process the sale for food and beer through their own point-of-sale system. This meant the food sales became part of the brewery’s financial books, which would lead to the issues listed above.

With SNAPnTAP, the sale gets processed by both merchants through any of our payment channels. SNAPnTAP splits the order so money for the taco platter (subtotal, tax, and tip, etc.) go to the taco truck’s bank account, and money for the 16oz IPA (subtotal, tax, and tip, etc.) go the the brewery’s bank account.

The Bottom Line

SNAPnTAP splits transactions by merchant so each merchant receives their portion of funds directly and instantly. The process is fully automated through our software. Accountants don’t have to do extra work, merchant payouts are immediate, and merchants’ financial books are just as accurate as they would be if the merchant weren’t collaborating.

We solve the pain of managing finances in collaborative operations so merchants can experience only the upside of working together. Contact us to learn more.